To carry out import and export activities of goods, personal or business required to complete the full procedure and papers related to customs. The declaration and processing is done at the place of customs clearance is different. So, do the customs clearance now? Let's HNT find out detailed rules on the place of customs clearance in the article below to understand information and more convenient in the process of import of goods.

Venue for customs what is?

Venue is the customs clearance area is arranged to receive, check, and handle documents related to exports and imports. This is where the headquarters of the work of the unit, customs, performing the function of control, verify the legality of the shipment according to legal regulations.

Venue is the customs clearance area is arranged to receive, check, and handle documents related to exports and imports

At this location, personal, or business will be filing a report, get the results of processing, and performs the necessary steps to customs clearance of goods. At the same time, the customs authorities will also be based on record and the actual goods in order to decide on the allow import, export, ensure proper compliance with processes and regulations.

>>> See more: Documents For Import And Export Is What? Specific Information

Rules on venue do customs clearance

So, do the customs clearance now? Establishing and operating these locations are not made arbitrarily, which must strictly comply with the provisions of the law. This is the important legal basis to ensure operations management, customs are made consistency, transparency and the right process.

Currently, the regulations related to the place of customs clearance is specified in Article 22 of the Customs Law, 2014 (as amended and supplemented by Law no. 35/2018/QH14) and Article 4 of Decree no. 08/2015/ND-CP of The government. The text in this role orientation in establishing the scope, functionality and condition to an eligible locations operational deployment customs clearance.

Places to do customs clearance

In accordance with current legislation, locations perform customs procedures specifically include:

– Locations receiving and processing customs documentation:

The registration procedure, check the customs documents is done at:

- Customs Department

- Headquarters department of Customs management, direct shipment

Locations receiving and processing customs documentation

– Locations reality check goods:

The commodity inspection can take place at many different locations, depending on the type of transport and regional declarations, including:

- The gate area roads, ports, aviation, international seaport, railway station, international transport

- Post office international and inland waterway ports are active import export

- Inland port was established service exports, imports of goods

- Places to check focus by the decision of the General administration of Customs

- Headquarters department of the Customs done check the goods according to the flow

- Area bonded warehouse, point lcl consolidation

- Production facilities, buildings, locations, organizations, fairs, exhibitions

- Test area in common between Vietnam Customs and customs neighbors

- Locations peculiarities of the General department of Customs approved in case of need

Locations reality check goods

Note on location, customs procedure

Under the provisions of the Customs Law 2014, the agency, organization or individual has the authority when performing the planning or construction of infrastructure in areas such as international borders, sea ports, railway stations related shipping, ports, civil aviation, economic zones, industrial zones, and... required to layout locations suitable to perform customs clearance.

Besides, the need to ensure there is dedicated space for the storage of goods exported and imported, fully meet the standards of supervision and inspection by customs authorities. Here is the important conditions to support activities, cross border trade takes place smoothly, at the same time improve the efficiency of state management in the field of import and export.

Need to ensure there is dedicated space for the storage of goods export and import

In summary, the identification and operate places of customs clearance is not only required by law, but also the key factors help to ensure the process of import and export takes place transparency, consistency and the right process. Understand the rules and scope locations are allowed to perform customs clearance will help the business be more active in logistics operations and minimize legal risks.

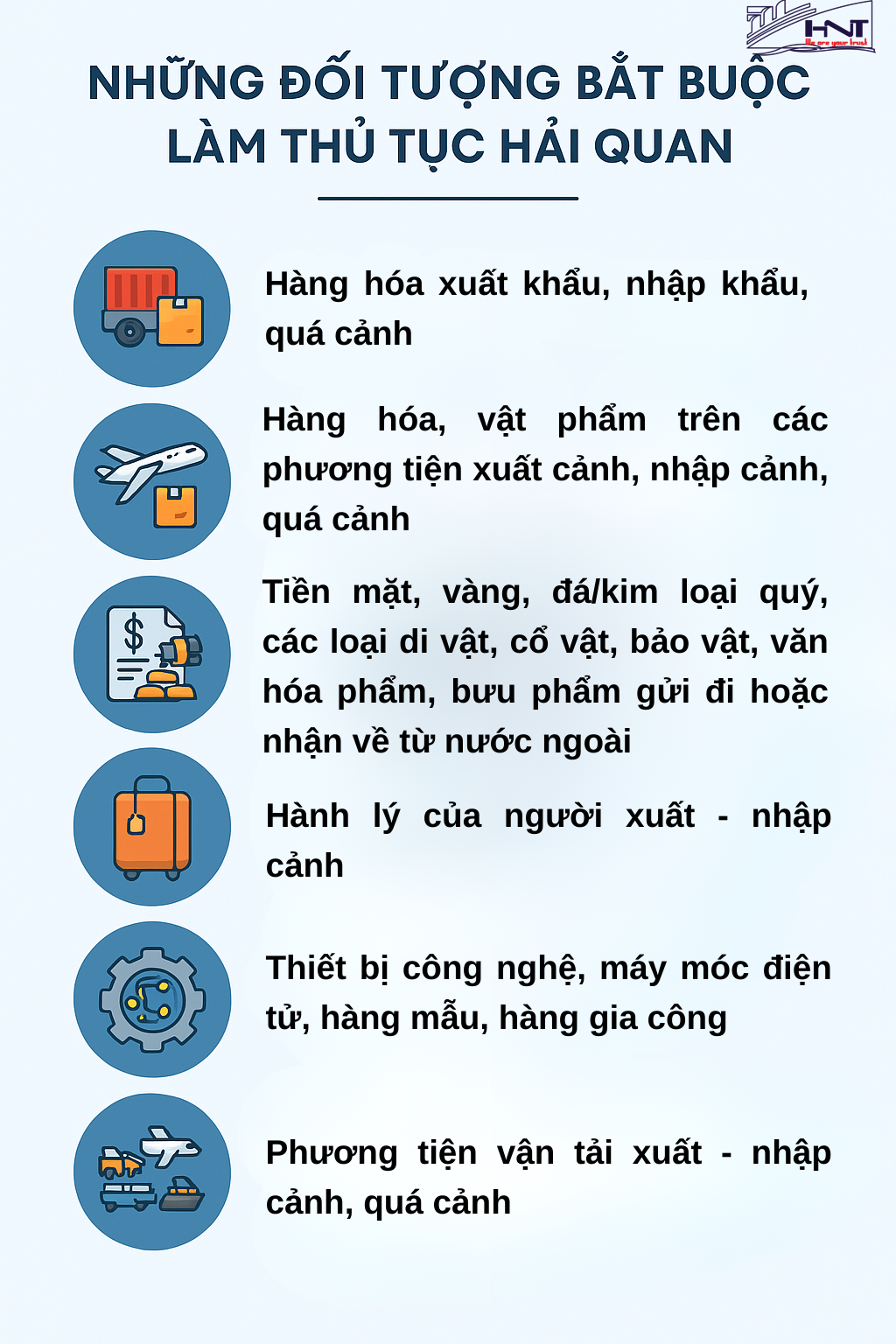

Subject to mandatory customs clearance

After you have defined locations, do the customs clearance, the next step is not to be missed is to determine the object to perform customs clearance. The understanding I have in this area or not will help individuals and organizations comply with the law, at the same time avoiding the risks are not worth having in the process of import and export.

Under current regulations, the mandatory subjects perform customs clearance include:

- Goods export, import or transit through the territory of Vietnam.

- Of goods and products is to carry or transport on the means of exit, entry and transit.

- Cash (including foreign currency, and Vietnam), gold, precious stones, precious metals, negotiable instruments, types of relics, antiques, national treasures, culture, food, parcels, and parcels sent or received from abroad.

- Luggage of the immigration exceed the standard tax-free.

- Technology equipment, machinery and electronics, samples, and other types of cargo peculiarities.

- Means of transport road, rail, air, road, sea, inland waterway when performing import or transit.

- Items circulation in the region under the supervision of the customs authorities.

Subject to mandatory customs clearance

Conclusion

Hope the article helped you understand the “customs procedure now?” as well as the regulations related to the place of customs clearance according to current regulations.

If you are looking for units provide services for customs declaration or the logistics solution package, HNT is proud to be a trusted partner, always with the business in every shipment import – export- including complex cases, require intensive processing. We are committed to cost transparency, does not arise, ensure efficiency and maximum savings for our customers.

Contact HNT Logistics for advice detail:

- Hotline: 0949.393.300 (Mrs. Dao)

- Hotline: 0911.446.060 (Mrs. Contest)